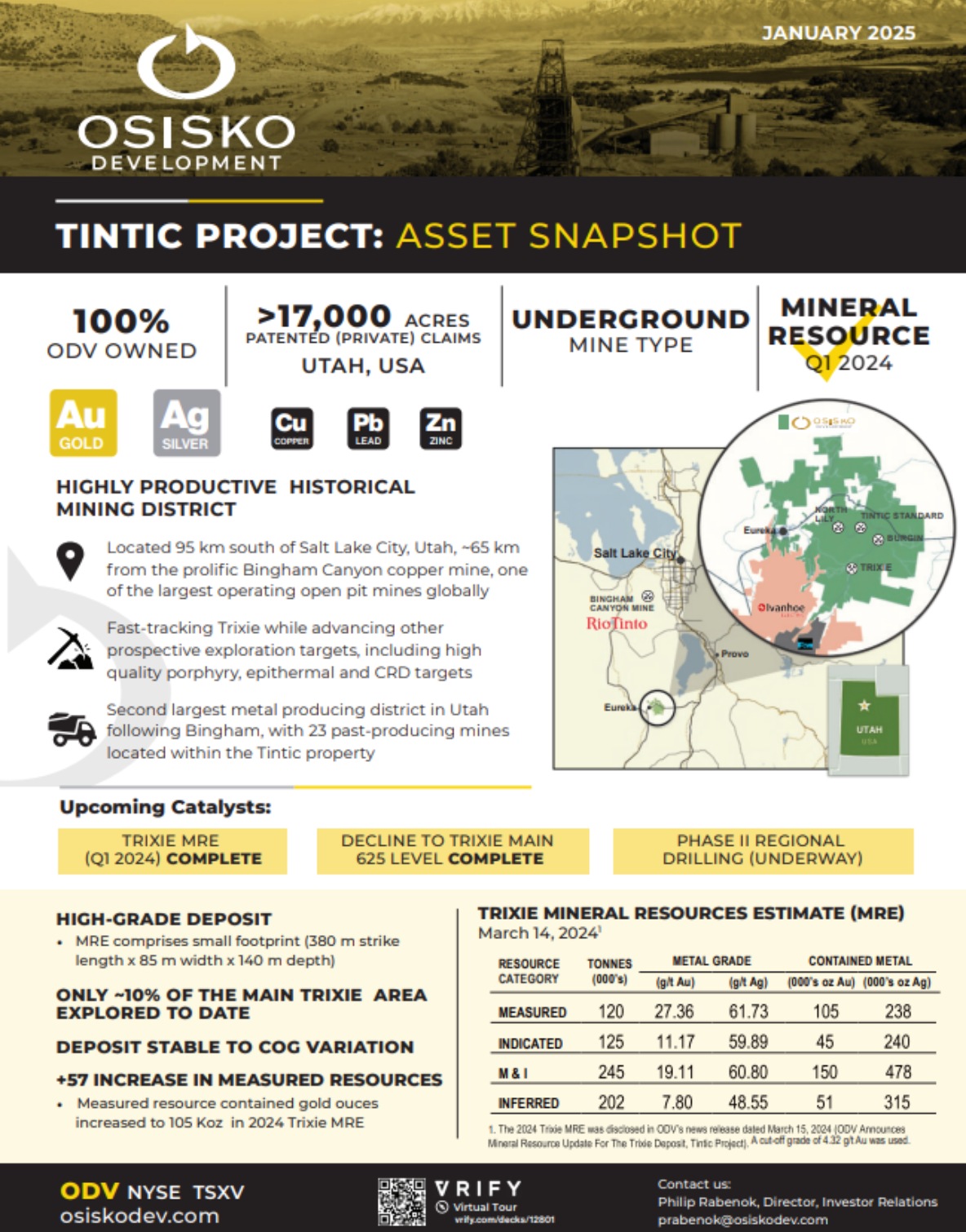

Overview

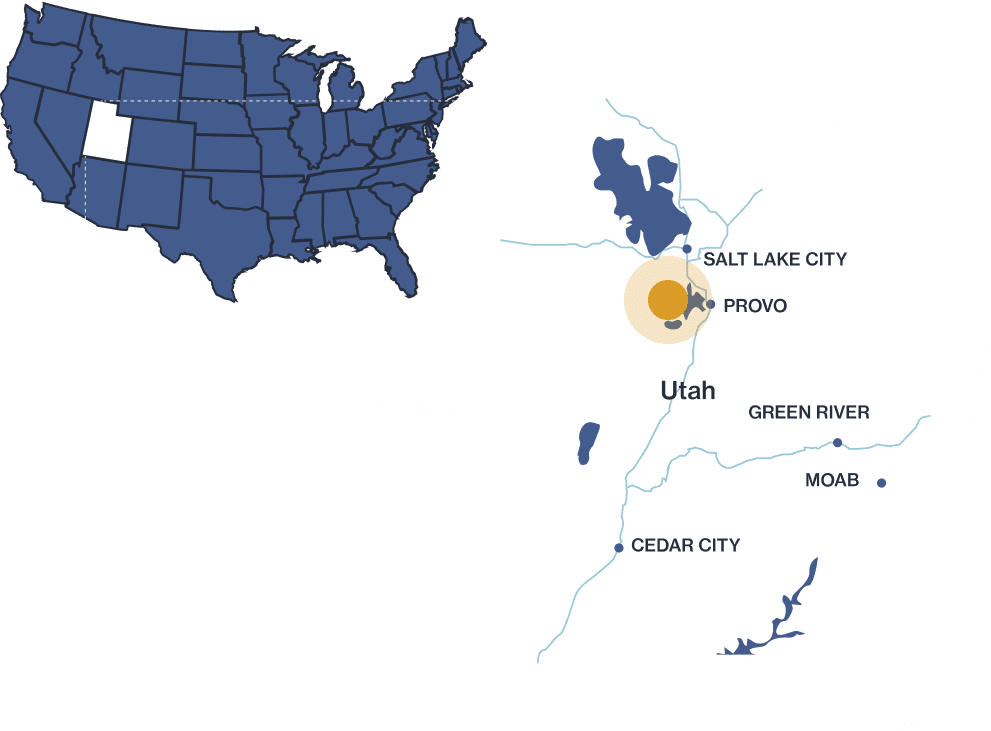

The Tintic Project is an exploration and development stage precious and base metal property, located in western Utah County, ~95 south of Salt Lake City. The historical Tintic District is the second largest metal producing district in Utah, following Bingham, historically producing 2.8 Moz of gold, 285 Moz of silver, 128 kT of copper, 1.2 MT of lead and 259 kT of zinc, of which the Main and East Tintic sub-districts were the main producing regions.

The Tintic Project encompasses most of the East Tintic District with 23 past-producing mines and includes the Trixie gold deposit, one of several gold and base metal targets, including porphyry, epithermal and carbonate targets within the project boundaries.

Mineral Reserves & Resources

Trixie Mineral Resources Estimate (March 14, 2024)

Scientific and technical information relating to the Tintic Project and the mineral resource estimate for the Trixie deposit (the "2024 Trixie MRE") and the assumptions, qualifications and limitations thereof, is supported by the technical report titled "NI 43-101 Technical Report, Mineral Resource Estimate for the Trixie Deposit, Tintic Project, Utah, United States of America" and dated April 25, 2024 (with an effective date of March 14, 2024), prepared for the Company by independent representatives of Micon International Limited (the "Tintic Technical Report"). Reference should be made to the full text of the Tintic Technical Report, which was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

The 2024 Trixie MRE comprises six mineralized zones within the greater Trixie deposit, including T2, T3, T4, Wild Cat, 40 Fault and 75-85 over a strike length of 530 m, a maximum width of 105 m and to a maximum depth of 195 m for the deposit and is 350 m from surface. These dimensions are for the overall size of the mineralized zone structures, with the 2024 Trixie MRE blocks contained within a smaller 440 m strike length, 60 m total width and 195 m depth footprint.

| Domain | Category | Tonnes | Grade (Au g/t) |

Contained Gold (oz) |

Grade (Ag g/t) |

Contained Silver (oz) |

|---|---|---|---|---|---|---|

| T2 | Measured | 22,678 | 106.27 | 77,484 | 115.99 | 84,572 |

| Indicated | 11,939 | 23.19 | 8,902 | 51.07 | 19,602 | |

| M+I | 34,617 | 77.62 | 86,387 | 93.60 | 104,173 | |

| Inferred | 1,996 | 9.82 | 630 | 61.38 | 3,938 | |

| T3 | Measured | 2,385 | 9.46 | 725 | 75.34 | 5,776 |

| Indicated | 970 | 5.47 | 171 | 57.32 | 1,787 | |

| M+I | 3,355 | 8.30 | 896 | 70.13 | 7,564 | |

| Inferred | 139 | 6.27 | 28 | 63.14 | 282 | |

| T4 + Wild Cat + 40 FLT | Measured | 94,784 | 8.93 | 27,227 | 48.41 | 147,520 |

| Indicated | 51,827 | 6.48 | 10,795 | 37.59 | 62,637 | |

| M+I | 146,611 | 8.07 | 38,023 | 44.58 | 210,156 | |

| Inferred | 104,676 | 6.57 | 22,127 | 38.57 | 129,792 | |

| 75-85 | Measured | - | - | - | ||

| Indicated | 60,008 | 12.93 | 24,943 | 80.95 | 156,185 | |

| M+I | 60,008 | 12.93 | 24,943 | 80.95 | 156,185 | |

| Inferred | 94,793 | 9.12 | 27,784 | 59.28 | 180,666 | |

| Total | Measured | 119,847 | 27.36 | 105,437 | 61.73 | 237,868 |

| Indicated | 124,743 | 11.17 | 44,811 | 59.89 | 240,211 | |

| M+I | 244,590 | 19.11 | 150,248 | 60.80 | 478,078 | |

| Inferred | 201,603 | 7.80 | 50,569 | 48.55 | 314,678 |