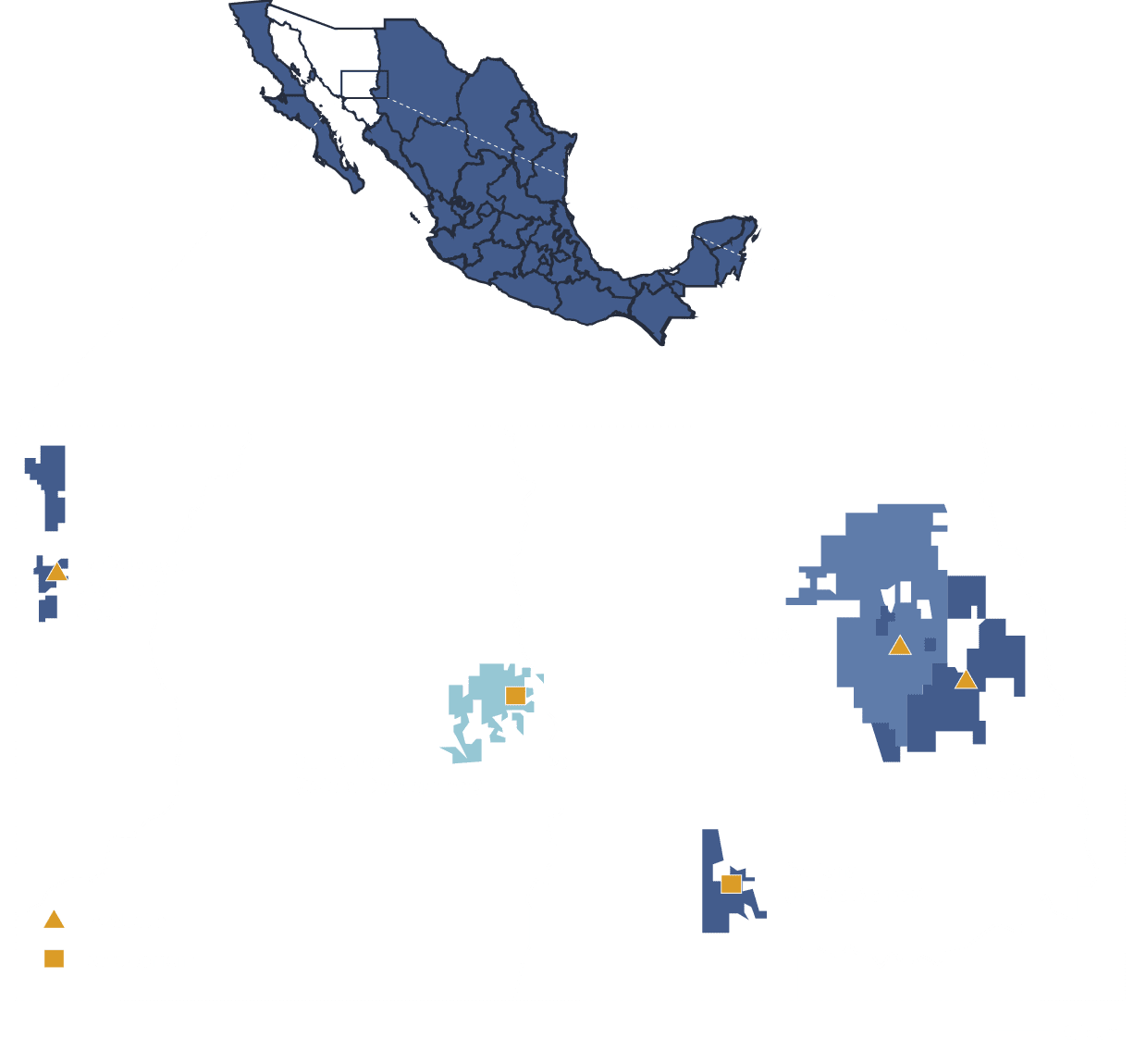

Sonora, Mexico

100%

Open Pit

11,338 ha of mineral rights

Gold, Silver

Awaiting next steps from the Mexican government on permitting

Overview

The San Antonio Gold Project is a past-producing oxide copper mine located in the state of Sonora, Mexico. In 2020, following acquisition of this project, the Company concentrated its efforts in obtaining the required permits and amendments to the permits to perform its activities. In Q1 2022, Sapuchi Minera commenced processing stockpile inventory through sodium cyanide heap leach pads and carbon-in-column processing plant. The Company realized its first gold sales in July 2022 and generated gold sales totalling 10,478 net ounces in 2022. In Q3 2023, processing of the remaining stockpile inventory was completed, and no production is anticipated henceforth. A total of 13,591 ounces of gold was sold from the San Antonio heap leach pad as at September 30, 2023.

On June 30, 2022, the Company announced an initial open pit mineral resource estimate (“MRE”) for the San Antonio Project. The 2022 MRE covers a portion of the Sapuchi – Cero Verde trend that encompasses five deposits: Sapuchi, Golfo de Oro, California, Calvario and High Life over approximately 2.8 km along strike, a maximum width of 600 metres (m) to a maximum depth of 300 m below surface.

The deposits are constrained within a geologic model of the hydrothermal breccia, the main mineralization control known to date. Additional drill targets remain underexplored on the property and new exploration drilling is recommended to verify historic data and potentially add new resource. Further infill and exploration drilling is recommended on the Project.

Mineral Reserves & Resources

San Antonio Mineral Resources Estimate (June 24, 2022)

Information relating to San Antonio is supported by the technical report titled "NI 43-101 Technical Report for the 2022 Mineral Resource Estimate on the San Antonio Project, Sonora, Mexico", dated July 12, 2022 (with an effective date of June 24, 2022) prepared for the Company by independent representatives of Micon International Limited (the "San Antonio Technical Report", collectively with the Trixie Technical Report and Cariboo Technical Report, the "Technical Reports"). Reference should be made to the full text of the San Antonio Technical Report, which was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

Indicated Resources

| Deposit | Weathering Zone | Tonnes (Mt) |

Au (g/t) |

Ag (g/t) |

Au Ounces (000) |

Ag Ounces (000,000) |

|---|---|---|---|---|---|---|

| California | Oxide | 0.6 | 0.93 | 2.8 | 17 | 0.05 |

| Transition | 0.2 | 0.79 | 3.3 | 6 | 0.02 | |

| Sulphide | 3.1 | 1.31 | 2.4 | 130 | 0.23 | |

| Total | 3.9 | 1.22 | 2.5 | 153 | 0.30 | |

| Golfo de Oro | Oxide | 0.2 | 1.07 | 2.8 | 7 | 0.02 |

| Transition | 0.1 | 1.19 | 2.8 | 6 | 0.01 | |

| Sulphide | 5.3 | 1.46 | 2.5 | 249 | 0.42 | |

| Total | 5.6 | 1.44 | 2.5 | 262 | 0.45 | |

| Sapuchi | Oxide | 1.9 | 0.85 | 3.6 | 53 | 0.22 |

| Transition | 1.4 | 1.04 | 3.6 | 47 | 0.16 | |

| Sulphide | 2.1 | 0.94 | 3.4 | 62 | 0.22 | |

| Total | 5.4 | 0.93 | 3.5 | 162 | 0.60 | |

| Total | Oxide | 2.7 | 0.89 | 3.4 | 77 | 0.29 |

| Transition | 1.7 | 1.02 | 3.5 | 59 | 0.19 | |

| Sulphide | 10.5 | 1.31 | 2.6 | 441 | 0.87 | |

| Total | 15.0 | 1.20 | 2.9 | 577 | 1.38 |

Inferred

| Deposit | Weathering Zone | Tonnes (Mt) |

Au (g/t) |

Ag (g/t) |

Au Ounces (000) |

Ag Ounces (000,000) |

|---|---|---|---|---|---|---|

| California | Oxide | 0.4 | 0.68 | 2.1 | 8 | 0.02 |

| Transition | 0.1 | 0.85 | 2.6 | 4 | 0.01 | |

| Sulphide | 1.1 | 1.27 | 3.8 | 46 | 0.14 | |

| Total | 1.6 | 1.10 | 3.3 | 58 | 0.17 | |

| Golfo de Oro | Oxide | 0.5 | 0.80 | 3.0 | 12 | 0.04 |

| Transition | 0.2 | 0.93 | 3.4 | 5 | 0.02 | |

| Sulphide | 5.7 | 1.29 | 2.5 | 237 | 0.46 | |

| Total | 6.4 | 1.24 | 2.5 | 254 | 0.52 | |

| High Life | Oxide | 0.5 | 0.84 | 4.2 | 14 | 0.07 |

| Transition | 0.2 | 0.73 | 4.5 | 4 | 0.02 | |

| Sulphide | 0.1 | 0.90 | 8.3 | 4 | 0.04 | |

| Total | 0.8 | 0.83 | 4.9 | 22 | 0.13 | |

| Sapuchi | Oxide | 3.2 | 0.74 | 3.7 | 75 | 0.37 |

| Transition | 1.6 | 0.92 | 3.6 | 48 | 0.19 | |

| Sulphide | 2.8 | 0.92 | 4.1 | 84 | 0.37 | |

| Total | 7.6 | 0.85 | 3.8 | 207 | 0.93 | |

| Calvario | Oxide | 0.1 | 0.53 | 0.0 | 2 | 0.00 |

| Transition | 0.0 | 0.55 | 0.0 | 0.0 | 0.00 | |

| Sulphide | 0.0 | 0.0 | 0.0 | 0.0 | 0.00 | |

| Total | 0.1 | 0.53 | 0.0 | 2 | 0.00 | |

| Total | Oxide | 4.7 | 0.74 | 3.5 | 111 | 0.50 |

| Transition | 2.1 | 0.90 | 3.6 | 61 | 0.24 | |

| Sulphide | 9.7 | 1.18 | 3.2 | 371 | 1.01 | |

| Total | 16.5 | 1.02 | 3.3 | 543 | 1.75 |